Best Lawyer To Sue Wells Fargo

I have a va loan.

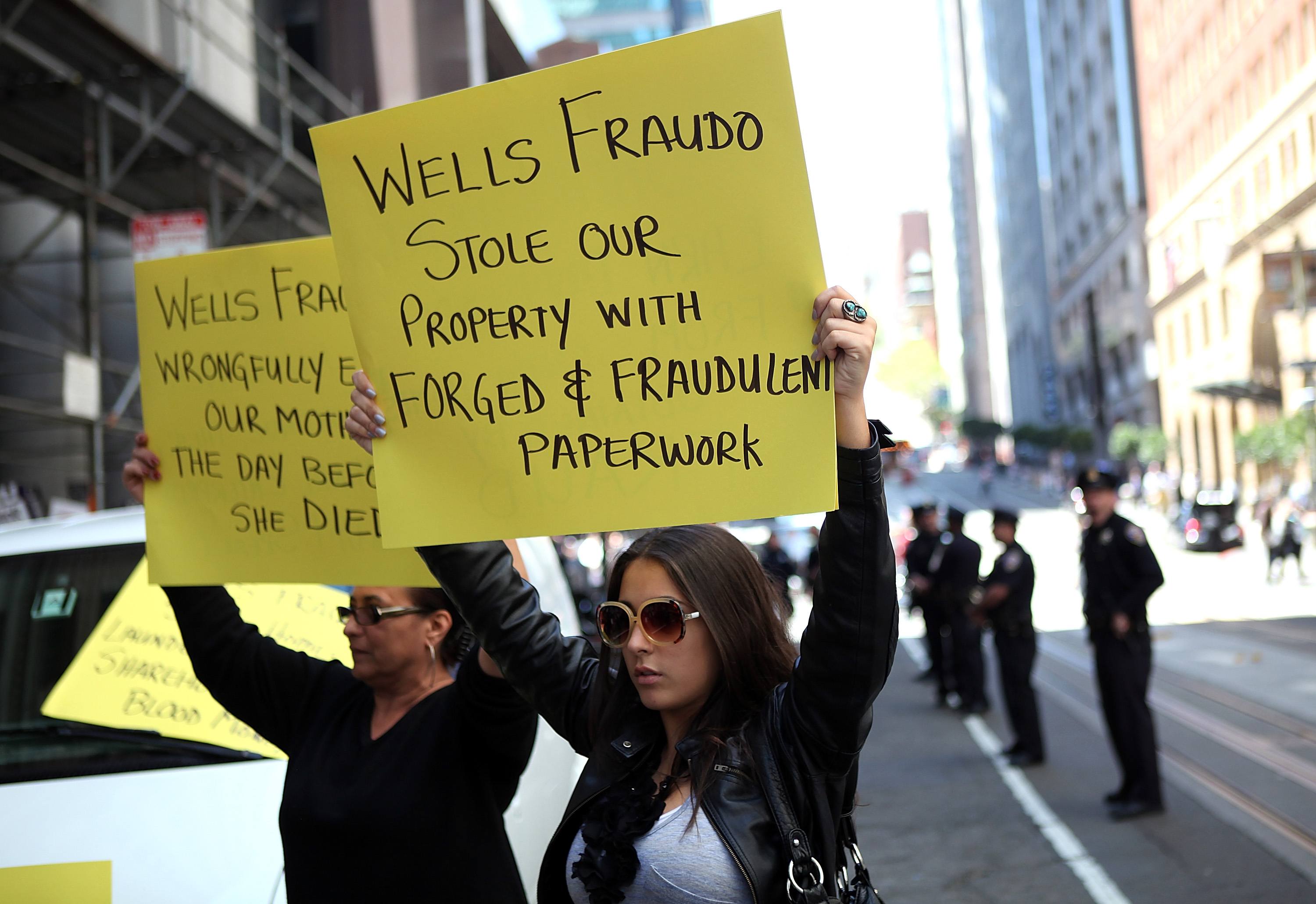

Best lawyer to sue wells fargo. I knew the numbers were off so i asked for my loan application. These are your options so you have a complaint against wells fargo s baking mortgage investing or credit card services maybe they re overcharging you or a salesperson misled you or their service isn t what they promised. How to sue wells fargo bank make your voice heard and make wells fargo bank pay. Wells fargo forgot to disclose extra insurance info before closeing and surprised me after saying i now owe 2700 3300 a year extra for 30 years.

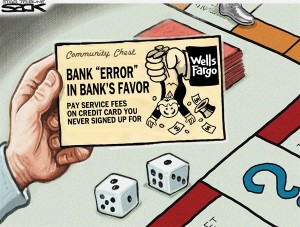

What kind of attorney do i need to sue wells fargo wells fargo has lie to me many times about fraud going on for months in my checking savings accounts. News meet the california whistleblower lawyer helping cities sue wells fargo public private litigation partnerships are becoming more and more customary when it comes to claims that require a. Asked on mar 08th 2017 on litigation california more details to this question. The consumer financial protection bureau fined the bank 185 million in september for the deceptive behavior but the potentially thousands of affected wells fargo customers could not sue the bank over the damage caused.

In march 2016 we could not refinance because of it. Wells fargo says it has set aside 8 million to remediate the wrongful disclosures caused by the software miscalculation. Split amongst the 545 people wells fargo says it wrongfully foreclosed on that would amount to only about 14 500 per person. Wells fargo reported that we were late on a payment in march of 2015 and reported it to the credit bureaus.

In the response from wells fargo they states liabilities around 1100 a month with 40 7 debt to income ratio. Wells fargo agrees to pay 110 million to resolve consumers class action lawsuit about unauthorized accounts. Thing were added to my computer account password changes user name chances address phone and email changes from wells fargo with out my consent. Wells fargo sent me the.

I filed a complaint with the cfpb.