Best Indian Bank To Open Nre Account

The bank offers 5 5 on daily balances upto rs.

Best indian bank to open nre account. Withdrawals however can be made outside india or. An nre account is an account maintained by a non resident indian where payments are credited only from outside india by way of drafts or rtgs. Joint accounts are permitted. Ratnakar bank nre account is one of the best in terms of interest payment in savings accounts of this category.

Payment as well remittance from abroad to any bank. Accounts can be in the form of savings current or term deposit. Recently i was doing some research to open an nri savings account in india and given their is so many banks both public and private sector are providing nri services i thought to do some quick checks on the best nri savings account i can get this moment one of my friends suggested me to open your nri savings account in hdfc bank other suggested that he has an account in kotak mahindra and. Nre accounts are free of income tax while the nro is taxable under income tax act.

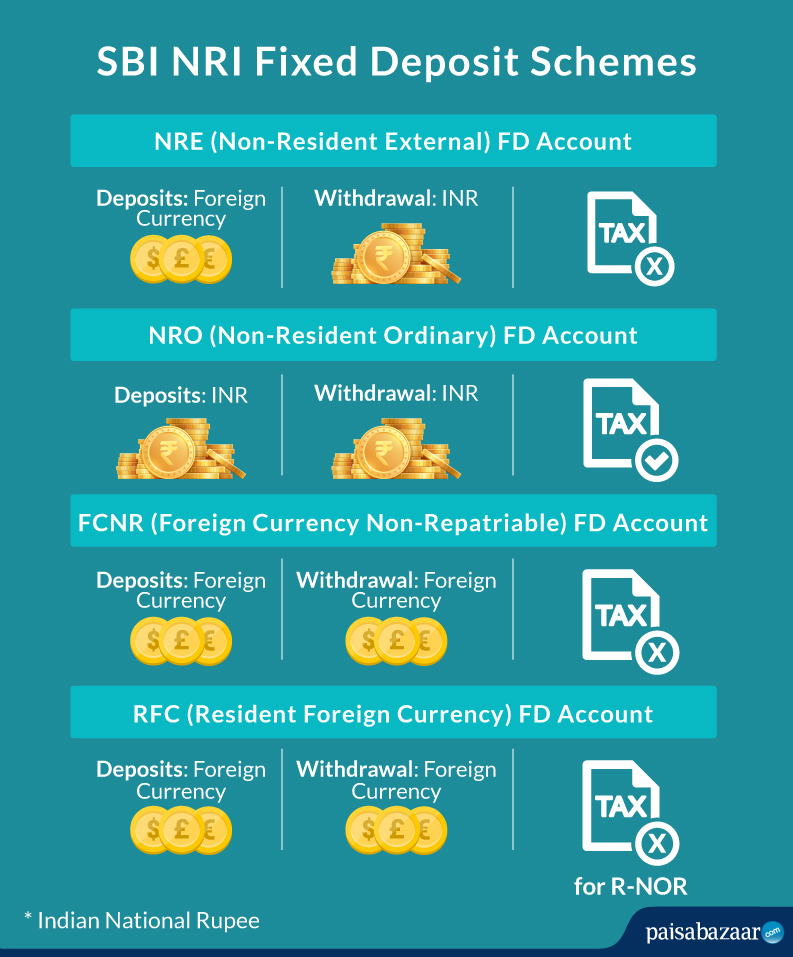

An nre account is a bank account opened in india in the name of an nri to park his foreign earnings. Nre accounts are exempt from tax. The state bank of india offers the following types of nri accounts. Benefits the investment term for nre account is a minimum of 1 year and a maximum of 10 years incase of an nro account you get minimum period of 7 days and a maximum of 10 years.

This nre account is most recommended because of the rate of interest offered. Features of nre deposits the account. Whereas an nro account is a bank account opened in india in the name of an nri to manage the income earned by him in india. Nre account interest accumulated on the balance is tax free minimum monthly balance of rs 1000 both principal and interest are fully repatriable tax free interest rate is 4 per annum and is calculated on a daily basis.

These incomes include rent dividend pension interest etc. Accounts can be opened jointly with any other non resident indian residents who are close relatives as defined in section 6 of the companies act 1956 of the nri. Repatriation of credit balance permitted. Banks in india provides an option for nris to open and operate either non resident rupee nre account and or a non resident ordinary rupee nro account.

1 lakh 6 on daily balances from rs 1 lakh to rs 10 lakhs and 6 5 for daily balances from rs 10 lakhs to.